Newsroom

Boom Bust Spectre Looms Large In Geo-Political Disarray – Biden and Xi’s policy errors have global ramifications

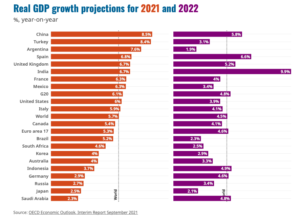

Joe Biden and Xi Jinping might seem the oddest of bed fellows in policy terms. Yet the global economic havoc their policy mis-steps – in tandem – are causing is of profound concern. Rather than “looking for the next Lehmans moment”, let us consider the actual ramifications of what is occurring in real time. The global economy (c. $100TRN GDP), after all, is directly affected by the policy decisions of the two largest (US: $21TRN GDP; China: $19TRN) sovereign state economies not to mention the direct impact this has on the European Union’s combined $15.5TRN GDP. On the fact of it, the global economy is emerging from the pandemic in positive fashion, with global GDP growth rates positive in major economies. That said, this is relative to the lows of the pandemic, and not particularly auspicious when compared to pre-pandemic levels. Even so, it is clear that many economies may struggle to rebound sustainably from the pandemic. Germany is lagging badly with a real GDP growth projection of only 2.9% for 2021.

Source: OECD Economic Outlook, Interim Report September 2021

Take, on the one hand, Joe Biden’s Bernie Sanders-inspired tax-and-spend inflationary economic policy. On top of the $5.4TRN spent by US Congress in the last year, he is looking to add a further $1TRN in infrastructure spending allied to a further $3.5TRN spend. So much, in fact, that the US Government must attempt to force through a debt ceiling increase to afford to cover such profligate spending in a US and global economy in dire need of productivity, not handouts, in the aftermath of the global COVID-19 pandemic. US junk bond sales are peaking, CLOs at highs – leveraged tech stocks are dominating the capital markets. All areas that will succumb to either inflation,

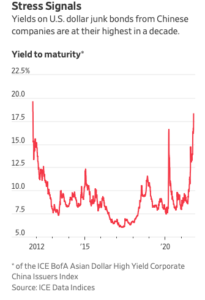

In contrast, Xi Jinping’s severe regulatory curbs aimed at ensuring common prosperity are turning into a metaphor for common poverty, with the growing multi-trillion dollar Chinese property market in crisis with defaults common – spearheaded by the major losses incurred by Evergrande, with other major Chinese real estate players faltering badly. With global investment and exports (particularly Germany and the EU) so focused on China in recent years – it is inevitable that global contagion from China-based turmoil will result. Sadly, the doomsters in the post-Lehmans, post-GFC world are too focused on the “one event” that may down the global economy – not the many contributing factors that are stifling any post-pandemic recovery. Like Biden, Xi’s regulatory curbs are not aiding productivity.

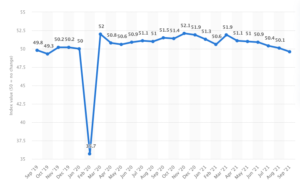

Manufacturing Purchasing Managers’ (PMI) Index in China – Sept 2019 to Sept 2021

Supply chain constraints are not helping. With Xi seemingly intent on waging a regulatory anti-capitalist war on major Chinese industrial and commercial actors, global logistics and commodities prices are on an upward trend. In the “aftermath” (a word only relevant to developed economies who have the infrastructure and purchasing power to accommodate extensive major COVID-19 vaccination programmes) of COVID-19, poverty and impoverished countries are sitting ducks – unable to counter the onslaught of such a major, immediate threat to local populations, livelihoods.

Rising global prices amidst low global productivity – with the physical threat of a global pandemic still affecting the most populous, impoverished nations of the world. With the leaders of the world’s two major economies, US and China, embarking on inflationary policies (Biden) on the one hand, and counter-productivity (Xi) regulatory reforms on the other. With the third largest global GDP component, the EU, all at sea with no effective monetary policy levers to protect its fragile, unproductive Eurozone as it emerges ready to taper its post-GFC QE programme. The conclusion is the onslaught of stagflation – rising price inflation amidst poor economic performance and low productivity – on a global scale. Recent industrial output data from Germany paint a very bleak picture indeed – with output down 4% in the EU’s major economic driver and largest economy.

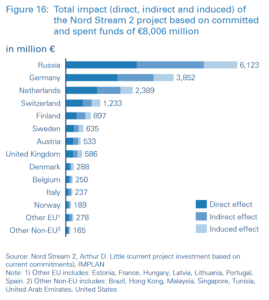

From an energy perspective, Russia’s Nordstream 2 gas pipeline to the European Union has put Russia in a very strong potential bargaining position. Once again, EU efforts to come up with the “right” answer to environmental concerns have seen their own Green policies – ironically – leading to energy price hikes that no-one, post-pandemic, can afford amidst slow economic growth. The new Olaf Scholz – likely “traffic light” coalition of his Social Democrats alongside the Liberal FDP and Greens signals a move away from the Angela Merkel-backed Nordstream 2 pipeline. Both Germany’s Greens and FDP oppose it – even Merkel has stated that Russia should not use the pipeline as a bargaining tool. The US has already sanctioned companies involved in the pipeline such as Gazprom and Nordstream 2 AG, and with energy prices on the rise and a controversial pipeline not given a green light – a full blown energy supply crisis is a clear and present danger.

COVID-19 was already a global hazard that is taking a great deal of effort, government spending to counter. The spectre of stagflation is a far worse predicament – on a global scale. Looking at the actors involved, a profligate, inflationary approach from the US alongside productivity-stifling from China is not a recipe for global post-pandemic recovery. Far from it, in fact. Worse still, diplomatic relations between the US and China (South China Sea, US Sanctions, Human Rights Abuses – Uighurs), US and EU (post AUSUK submarine deal) are poorer than ever. So an immediate coordinated response does not seem likely.

Productivity is the only solution to global recovery – key policymakers seem to have completely ignored this. COVID-19 vaccination rates – a key economic driver as the world emerges from the pandemic – are improving in developed countries, but there is still much to do in impoverished, highly populous parts of the globe to combat new variants such as Delta.

(1) N. Sargen, ‘China’s Property Market At The Brink: Not A Lehman Moment But An Economic Threat’, FORBES (Sept 20, 2021)